Annuity loan or serial loan?

What really suits you best and which type of loan should you choose?

September 9, 2023

eiendoms-admin

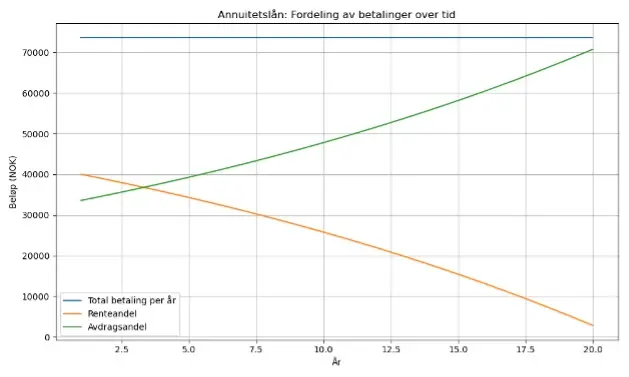

Annuity loans are the most common form of loan. You will then pay the same monthly amount throughout the term of the loan, provided that the interest rate is stable. The monthly amount consists of installments and interest costs. At the start, the installment portion is smaller, and the interest portion is larger. As the loan is paid off, the installment portion increases, and the interest portion decreases.

An annuity loan has the same installment amount each month, which makes the product predictable. It is therefore a good fit if you like predictability and want a slightly more spacious economy. Annuity loans are a good option for those who are going to buy their first home, renovate or start a family.

Alternatively, an annuity loan with a shorter term can be at least as favorable as a serial loan. It may also suit you who have plans for the future or know of upcoming changes in your own finances, such as retiring before the loan is paid off.

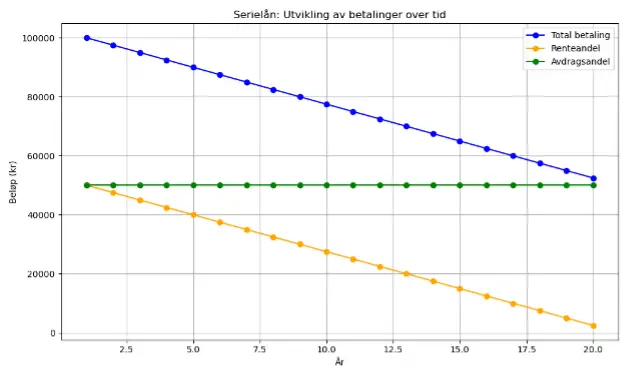

A serial loan may be suitable for you who borrow less than your borrowing capacity can handle, because you can afford to pay it. With a serial loan, you pay off the loan with a higher installment amount at the start, but you will have less and less to pay as the loan is paid off.

The installment part is the same every month, but the interest part falls. The result is that the monthly amount becomes smaller for each payment to the bank. If you can afford to maintain the large payments at the start of a serial loan, you will pay less interest in total over 25 years than with an annuity loan with the same duration.

Annuity loan

Here’s a visual illustration of an annuity loan, showing how each annual payment consists of a combination of interest and installments over time:

Explanation:

- Total payment per year (blue line): This amount is constant throughout the term of the loan.

- Interest share (orange line): Starts high because interest is calculated on the full amount of the loan, but decreases as the debt is reduced.

Installment share (green

Serial loan

Here is a visual illustration of a serial loan, showing how the payments develop over time:

Explanation:

- Total payment (blue line): Starts high and gradually decreases, because interest is calculated on an increasingly smaller residual debt.

- Interest share (orange line): Decreases steadily as the loan is repaid.

- Repayment percentage (green line): Is constant each year, which is typical for serial loans.

Free and quick case management

With us, you will be assigned a permanent advisor who will help you throughout. After

a pleasant conversation with you, we map your financial situation.

This is what we can help you with