Cottage loan

A cabin loan is a mortgage where the bank takes security in the cabin.

You can borrow up to 60% of the purchase price, but if you have additional security, you can borrow the full purchase price.

This is how we help you:

Fill in the application form

It only takes a few minutes and is completely

free and non-binding for you.

We talk to the banks

Your advisor will talk to our partners and find the

best solution for you.

Receive a non-binding offer

Once we've landed the solution we

most believe in, we'll contact you for a

no-obligation quote.

Equity for cabin loans

How much equity do you need to apply for a cabin loan?

The main rule is that you can borrow from 60-75% of the purchase price. Here it varies slightly in relation to location and standard. If the cabin is located in a well-functioning and attractive cabin area where most cabins are sold quickly, you will often be granted a higher mortgage.

The difference between what you can borrow against the cabin and what it actually costs must be provided as equity.

All or part of the cabin loan can also be offered against additional security in your own home.

If you’re buying an energy-efficient cabin or upgrading an existing cabin to energy label A or B, you can apply for a green cabin loan.

Do you need to borrow a little extra to repair or upgrade the cabin?

If you already own a cabin, but see that it is time for renovation or necessary maintenance? Then you can contact us to hear what opportunities you have.

Would it be best for you to borrow a little extra on your cabin, or to refinance your mortgage your mortgage?

Is a home loan an option that suits you, or a short-term loan because it must be repaid within a short time.

There are many types of loans and solutions, but after a conversation with us, we’ll find the bank and loan that suits you best.

The work we do in obtaining offers is both free and non-binding for you as a customer.

Building a cabin

There are a lot of things that need to be in place when you start your construction project.

Here are some questions you should ask yourself:

→ What will the monthly costs be and can you afford it?

→ Make sure to set up a detailed calculation where you include mortgage, electricity, ground rent, property tax, insurance, TV/wifi etc.

→ Can partial rental be an option to cover some of the costs?

→ Should it be a modern or traditional cabin?

→ Architect-designed or element cabin?

→ What has the municipality included in the zoning plan, and could it limit the opportunities you envision?

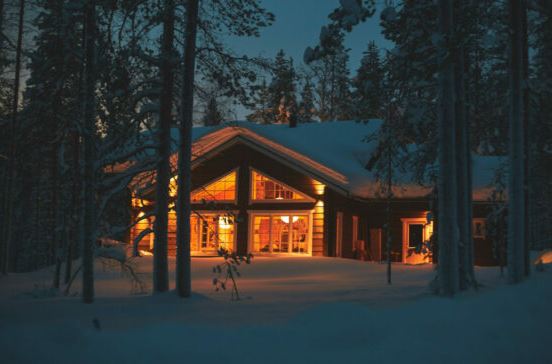

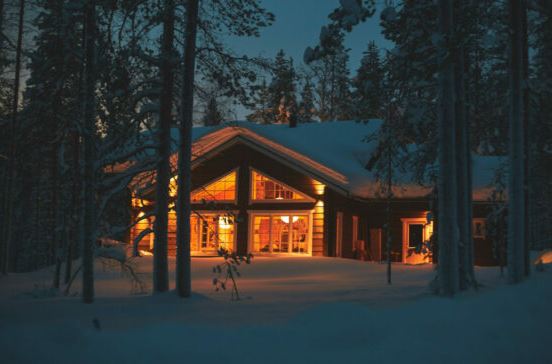

Where do you want a cabin?

Do you want a cabin by the sea or a fireplace and raw nature in the mountains? We can help you find the right loan for a cottage or holiday home. How much does it cost to build a cabin? What should you think about before starting the process? Our advisors make sure you get the best possible solution for your new cabin loan.

If you can provide security for the entire amount in property in Norway, you can also borrow for a holiday home abroad.

Conditions for cabin loans

- Total debt should not exceed five times total annual gross income.

- Loans can be granted up to 60% of the property value/purchase price

- With additional collateral in another property (e.g. housing), you can borrow up to 100% of the purchase price

Cabin loan calculator

Lånesum

Antall år

Nom. rente (%)

Etabl.gebyr

Termingebyr

Terminbeløp:

0 KrTotalbeløp

0

Kostnad

0

Etabl.gebyr

1500 Kr

Termingebyr

50 Kr

Effektiv rente

-

This is how we help you:

Fill in the application form

It only takes a few minutes and is completely

free and non-binding for you.

We talk to the banks

Your advisor will talk to our partners and find the

best solution for you.

Receive a non-binding offer

Once we've landed the solution we

most believe in, we'll contact you for a

no-obligation quote.

Advantages of owning a cottage

Advantages of renting a cabin

- You have access to the cabin exactly when you want

- You can decorate exactly as you like

- You can create great memories for your family and future generations

- You can increase your income by renting out the cabin

- If the market rises, you will be able to extract a good chunk of money from the increase in value when selling

- You can experience many different destinations and not feel like you “have” to use your own cabin

- You don’t increase your debt or tie up your finances

- You have no increase in fixed costs

- You avoid the maintenance of several properties

- You avoid depreciation and loss on the cabin if the property market drops

We help you with loans for cabins

Owning a cabin is also about much more than costs. It’s about quality time with friends and family, memories you create together and the calm you often find as soon as you enter the cabin door.

- Børge Finsæther, Eiendomsfinans Harstad

Free and fast case management

With us, you will be assigned a dedicated advisor who will help you every step of the way. After

a pleasant conversation with you, we map out your financial situation.