Tax return 2024

Here are our top tips and advice on tax deductions

tax deductions and which items you should take an extra look at

March 12, 2025

Julianne Gåsvær

What are tax deductions?

Deduction means that you can deduct certain expenses or costs from your income when calculating your tax.

This will thus help to reduce the total tax you have to pay.

Examples of costs you can deduct include interest on debt, childcare expenses and travel expenses between home and work.

Banking, loans and insurance

For those who have a loan, the lender usually reports the interest paid to the Norwegian Tax Administration, and this interest is usually pre-filled in your tax return.

If you have paid interest to suppliers such as Klarna, you must register this yourself under the item “Bank, loans and insurance” and then under “Other loans”.

If you had debt to such at the end of 2024, you can state this amount as a loan under “other loans”.

Have you refinanced, bought a home or switched banks?

Then you get a deduction for:

- costs for taking out a loan, including establishment fees.

- costs in connection with refinancing of loans in order to obtain a lower interest rate, including costs for an appraiser.

- fees to housing associations related to special repayment of IN loans (joint debt with individual repayment)

There is a 22% deduction for interest on all loans. You must have earned more than 88.250,- in 2024 to be able to benefit from the deduction.

Tax on 1-2-3

Do you find it difficult to understand the difference between tax returns, tax cards and tax assessments? We think this video from the Norwegian Tax Administration provides a good explanation:

Do you want money you're owed paid out quickly?

If you check and submit your tax return early, you can also get your money back quickly. The first payments of tax credits can start as early as the 19th. March.

Be aware of fraud attempts!

We came across a good article on Dine Penger that we think is worth sharing. You should be extra critical if you get a message that says you can get the money quickly if you click on a link where you are asked to enter your name, email address and card information.

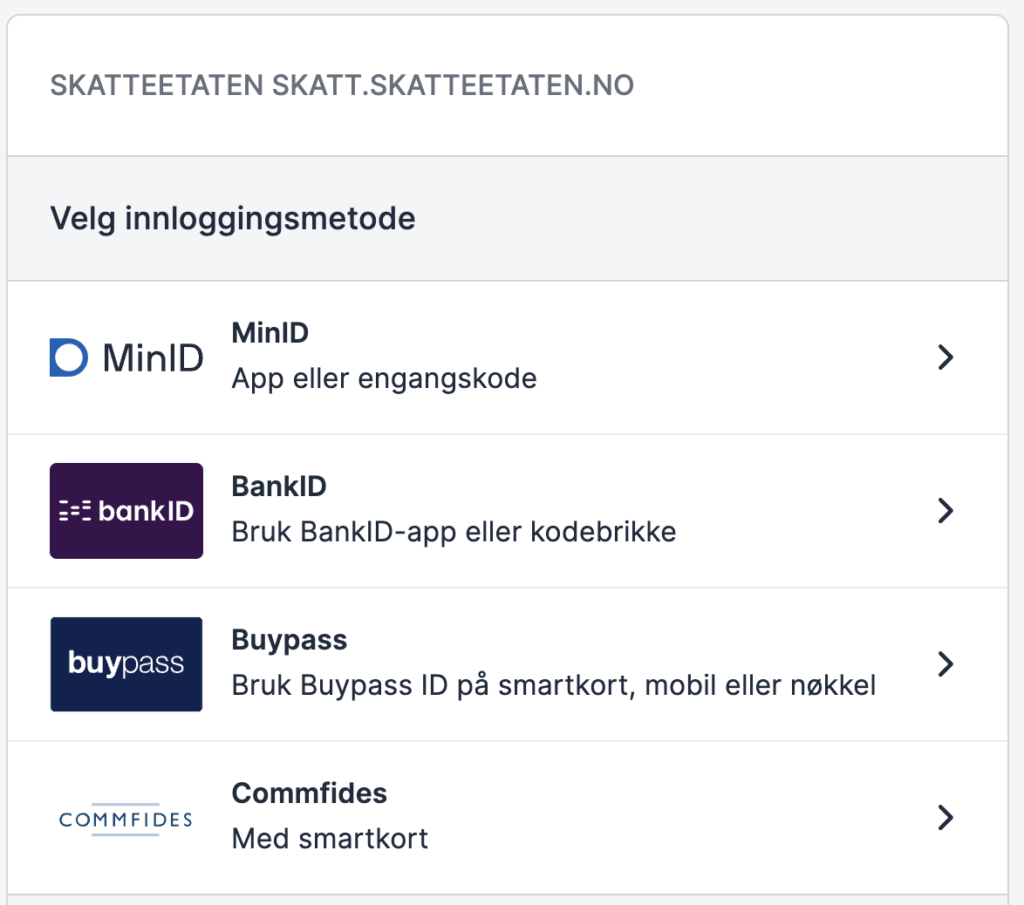

The Norwegian Tax Administration never sends links in text messages or emails – they always ask you to go to skatteetaten.no or altinn.no to log in from there.

Private loan with interest

If you have borrowed money from friends or family on which you pay interest, this can also be entered under “other loans”.

Parental allowance

You can receive up to NOK 25,000 for one child and a further NOK 15,000 per additional child. It doesn’t matter which of the children you’ve had the most expenses with. The deduction applies to the costs you incur for the care and supervision of children under the age of 11. You can also enter extra travel expenses if you pick up and drop off children at school/nursery on your way to and from work. You can also claim a deduction for expenses for after-school care, which is a fully-fledged alternative to after-school care at primary school.

NB! Also applies to children older than 11 years of age with additional care needs.

Travel deduction

You must fill this in yourself. If you travel to work at least 230 days a year and live more than 18 km from work, you are entitled to a deduction for costs up to NOK 97,000. Here you must deduct the deductible, which is NOK 14,400.

Cohabiting or married?

Here there are differences when it comes to joint debt. The rule is that the loan is automatically distributed equally between the borrowers on the tax return. If the distribution is incorrect, this must be changed. Previously, only the main borrower received all loans and interest on loans on the 2024 tax return.

For many, this is a good distribution, but perhaps not in cases where parents are co-borrowers together with children, but it is the child who pays all the monthly costs. If you are married, you can distribute the money as you wish.

Cohabitants and others who share a loan must divide the loan equally between them, unless you have a different agreement.

If there are two of you responsible for the loan, each person’s share is 50 percent. If there are three of you, each of you gets 33.3 percent. It is irrelevant who has paid the interest. The distribution is based on the proportion of the loan you have or any agreement you have, e.g. a cohabitation agreement that describes a different distribution of the loan.

More articles